Reinventing the business overdraft for the growth economy

Reinventing the business overdraft for the growth economy

.png?width=300&name=Bourn%20-%20new%20dashboard02%20(1).png)

Access your revenue to accelerate growth and eliminate cash flow stress.

Access your revenue-generated cash flow directly from your bank account. Accelerate your growth, invest in opportunities, and eliminate cash flow stress.

Introducing

The Flexible Trade Account

The Flexible Trade Account. Financing Your Business Ambitions.

Financing Your Business Ambitions.

Flexible

Commitment-free access to secured lending, available when you need it. Only access the working capital you need to drive growth your way. Manage today’s expenses or invest in the future.

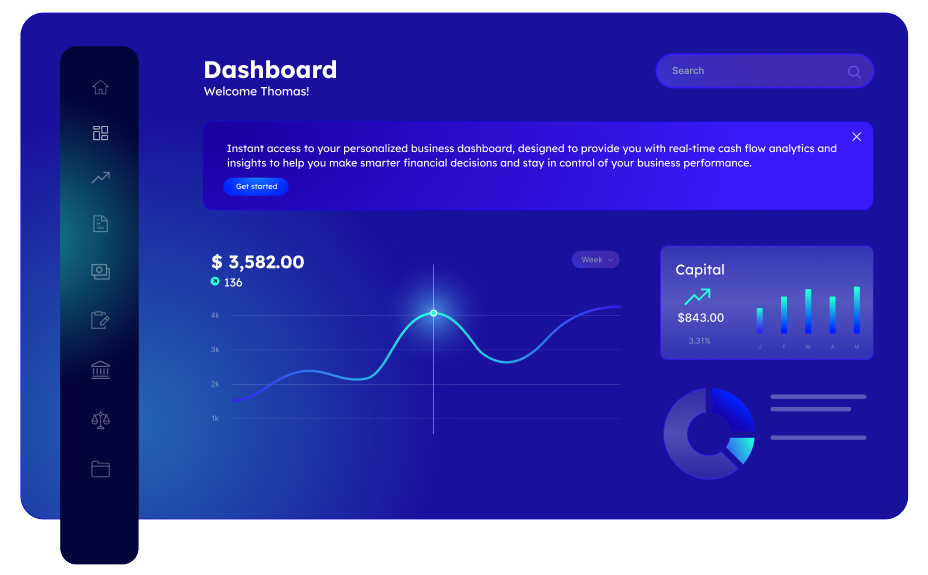

Smart

Leverage real-time data and insights to manage cash flow effectively and make smarter business decisions, all through a single, intuitive dashboard.

Automated

Save time with automated funding limit updates, transaction approvals and payment reconciliations fully integrated into your everyday business processes.

Fast

Get funding quickly and securely, whenever you need. Say goodbye to delays - pay and get paid on your schedule.

Proudly partnered with

.png?width=300&name=Validis%20logo%20(1).png)

.png?width=300&name=Validis%20logo%20(1).png)

Simplifying working capital.

01

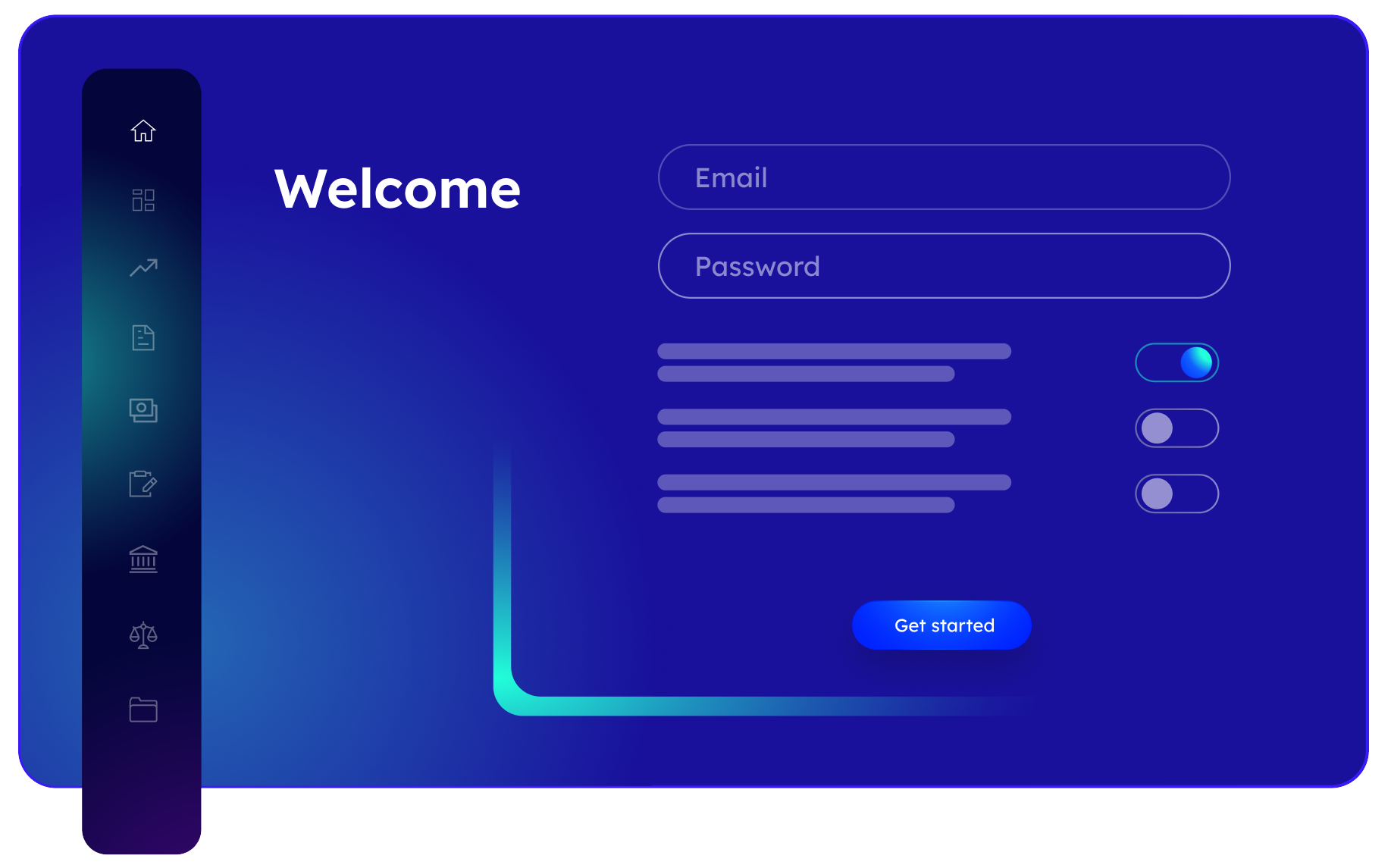

Open an Account

02

Unlock Funding Limits

03

Make Payments

Open an Account

Create your account in minutes with basic business information and connect to your bank and accounting software.

Unlock Funding Limits

Access your personalised business dashboard with real-time cash flow analytics and fully dynamic credit facility.

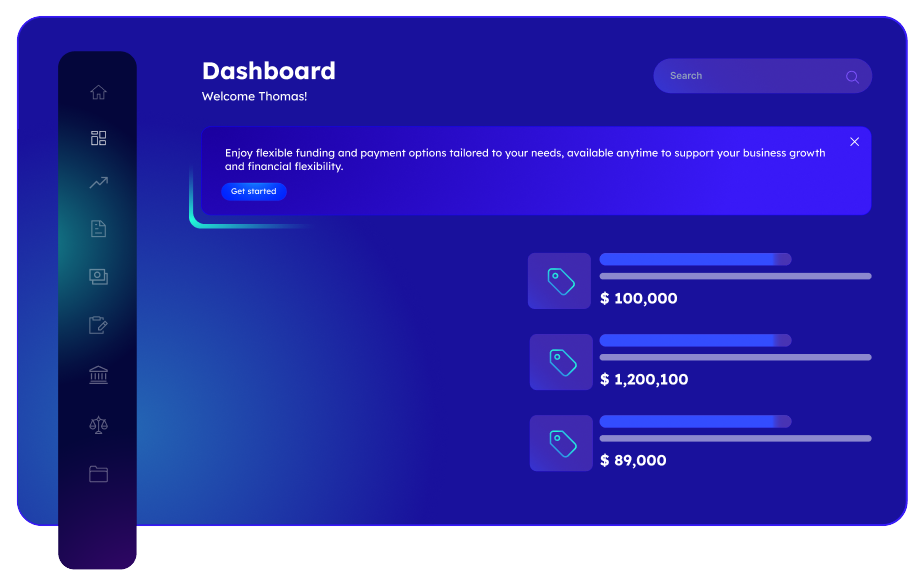

Make Payments

Transfer funds to your primary account or make direct payments. View and reconcile all transaction in your accounting package.

Insights

Explore the latest trends, updates, and insights in SME financing.

Bourn secures £3.5 million to accelerate the roll-out of its modern alternative to the business overdraft.

London, 1 December 2025 – Bourn, the UK fintech reinventing the business overdraft for the growth economy, has raised £3.5 ...

Start Reading

Don’t build it. Embed it.

The smarter way for accounting platforms to power SME growth, and a faster path to working capital for your users.

Start Reading

A Smarter Foundation for SME Lending: Why Banks Need a New Operating Model

SME lending doesn’t need a better UI - it needs a new foundation. Banks have spent years digitising SME lending - scanning ...

Start Reading

Frequently Asked Questions

Who is Bourn

Bourn is a financial technology company addressing the cash flow challenges faced by UK SMEs. Our mission is to simplify working capital for growth businesses.

What is a Flexible Trade Account?

A Flexible Trade Account (FTA) is a business credit and payment solution designed to help SMEs manage cash flow effortlessly.

How does it work?

An FTA works just like a business overdraft, giving businesses access to a payment account and flexible line available on demand. The account is connected directly to your accounting system so we can keep your funding line up to date and support your financial operations.

What makes this different to invoice financing?

Unlike traditional invoice finance, which relies on manual processes and significant amounts of paper, FTAs are designed for automation, streamlining onboarding, payments, reconciliations, and limit management for businesses.

Who is typically eligible for a Flexible Trade Account?

FTAs are designed for any UK-based businesses that trade on credit terms with other businesses, providing flexible funding based on outstanding invoices.

What accounting systems can Bourn connect to?

We connect to over 14 major cloud accounting platforms, including Xero, Quickbooks, Sage and NetSuite.

Is Bourn's Flexible Trade Account available internationally?

Currently, we’re operational in the UK, with plans to expand globally. If you’re in another jurisdiction, let us know, and we’ll update you on our roadmap.

Is Bourn a bank?

Bourn is not a bank. We partner with banks and alternative finance providers to help provision working capital for SMEs.

How secure is the information I share with Bourn?

We prioritise your security and ensure all data is encrypted and handled according to GDPR and industry standards.

Who is Jason Bourne?

We don't know.

But we're confident in saying he certainly couldn't simplify your working capital like we can.

But we're confident in saying he certainly couldn't simplify your working capital like we can.